Past Splash pieces have covered who we are and what we do. This month we’re sharing straight-up, clip-worthy tips you can use and pass along to neighbors.

Past Splash pieces have covered who we are and what we do. This month we’re sharing straight-up, clip-worthy tips you can use and pass along to neighbors.

The Top 5 Most Common Scams

1) “Imposter” calls/texts

Someone claims to be from your bank, utility, Medicare, a delivery service, or even a grandchild in trouble.

What to do: Hang up. Don’t click. Call the organization back using a number you already trust (your card, statement, or official website).

2) Tech-support pop-ups

A scary screen says your device is infected and urges you to call a number.

What to do: Close the browser/app. Restart your device. Never grant remote access or pay in gift cards or crypto.

3) Package/“missed delivery” texts

A link says you owe a small fee to release a package.

What to do: Delete the message. Check your real tracking number directly with the carrier’s official site/app.

4) Government or utility “shut-off” threats

A caller demands immediate payment to avoid arrest or service disconnection.

What to do: Real agencies don’t do surprise pay-now demands. End the call and verify through your normal bill-pay portal.

5) Romance and “too-good” investments

A new online friend or advisor nudges you into private messaging and fast money moves.

What to do: Slow everything down. Talk to a trusted friend/family member first. If it must be secret or urgent, it’s likely a scam.

10-Minute Security Tune-Up

• Silence unknown callers on your phone; let voicemail screen for you.

• Turn on multi-factor authentication (a code texted to you or an authenticator app) for email, banking, and shopping.

• Use strong passphrases (four random words) and avoid reusing passwords.

• Update devices/apps so security patches are current.

• Freeze your credit (free) with Equifax, Experian, and TransUnion; set transaction alerts with your bank.

Red Flags at a Glance

• Pressure, panic, or secrecy (“Don’t tell anyone”).

• Payment by gift card, wire, or crypto only.

• Caller won’t let you hang up or call back.

• Links that look odd or slightly misspelled.

• Requests for remote access to your computer/phone.

If You Think You’ve Been Targeted

1. Stop contact (hang up, delete, block).

2. Document what happened (numbers, messages, usernames).

3. Call your bank/card issuer immediately if any info or funds were shared.

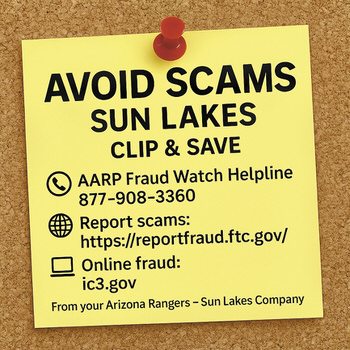

4. Report it to the FTC at reportfraud.ftc.gov and online fraud to the FBI at ic3.gov. Reporting helps protect neighbors.

Community Wisdom

• When in doubt, sleep on it. Scams hate time.

• Two-person rule: run money decisions by a spouse, friend, or trusted neighbor.

• Club tip: Read the sidebar at your next meeting, and ask members to share with a neighbor who might not read the Splash.

The No Scams Checklist

• Let unknown calls go to voicemail.

• Don’t click links in unexpected texts/emails.

• Verify using a phone number or website you look up.

• Turn on multi-factor authentication for key accounts.

• Update phone, tablet, and computer this week.

• Use a password manager or unique passphrases.

• Freeze credit with all three bureaus.

• Set bank/card alerts for large or unusual charges.

• Never pay with gift cards, wire, or crypto for “urgent” issues.

• If pressured or it must be secret, stop and talk to someone you trust.